Introduction

The operation of Uber is quite simple: those capable of providing a taxi service apply and sign up to Uber, through the Uber app a customer requests the service, Uber pairs up the customer with a suitable driver in the area who is offered the “gig” through the app, which the driver can either accept or reject, on completion of the journey the customer makes a payment through the app, with Uber making a payment to the driver from the customer payment minus their fee: the driver does not have contact with the customer until they accept a job, and, importantly for this blog, at no point does Uber expressly obligate themselves to offer a driver work, nor does a driver obligate themselves to accept any work offered. It is this idea of mutual obligations, that of a purported employer obliging themselves to offer work with an obligation on a driver to accept work, which much of the recent Uber decision focuses.

The Uber decision has been described as a landmark employment decision, and it is easy to appreciate why, especially with the numbers employed in similar ways in the so called gig economy.

UK Employment Law and Uber

From the outset it is worth noting that UK employment law has three status classifications: employee, worker and that of independent contractor. Employee status is the golden classification, with a number of the strongest employment rights reserved for this category (including unfair dismissal and redundancy). The label of independent contractor is attached to the genuinely self-employed. They are a business in their own right and are often categorised as having customers or clients for whom they complete work for, rather than working for another. Worker status is the intermediate category, sitting in between employee status and independent contractor status. This status, like employee status, also acts as a gateway to certain rights, including whistleblowing protection, the right to minimum wage and paid holiday leave (all of which were being pursued in the Uber litigation).

As alluded to above, in Uber the drivers brought a claim for holiday pay rights, minimum wage and whistleblowing protection, all of which required worker status to be established, and thus this was the primary focus of the Tribunal in its decision. The term worker has a specific legal definition, which is contained at section 230(3)(b) of the Employment Rights Act 1996:

“In this Act “worker” means an individual who has entered into or works under [A] contract […] whereby the individual undertakes to do or perform personally any work or services for another party to the contract whose status is not by virtue of the contract that of a client or customer of any profession or business undertaking carried on by the individual.”

The claim brought before the Employment Tribunal in Uber was on the basis of two ‘test Claimants’ Mr Aslam and Mr Farrar, selected from 19 Claimants who all argued that they had worker status with Uber. This is important from the point of view that this decision only relates to these 19 drivers, although the finding of the tribunal has potential to apply to the other 30,000 Uber drivers operating in London, and a total of 40,000 in UK.

What was actually decided in Uber?

The Tribunal concluded on the facts presented before them that the drivers were indeed workers of Uber. They were considered to be workers of Uber from the point in time when they (a) switched on the app, (b) were within the territory in which they were authorised to work, and (c) were able and willing to accept assignments. When these three conditions were satisfied a driver would be a worker, and thus entitled to the worker status rights that were the subject of this claim.

But was the Tribunal correct… Time for the legal part…

The short answer is probably no, although a more apt answer would be, ‘well, kind of’. The case required two key issues to be analysed: (i) was there a contract between Uber and the drivers, and (ii) if there was a contract, was it a worker contract.

(i) Contract between Uber and the drivers?

In terms of finding a contract between the drivers and Uber the Tribunal was arguably correct. The approach by the courts to the employment relationship has long focussed on the practical reality of the relationship, rather than solely on the express contractual position, as seen in the Supreme Court’s decision in Autoclenz Ltd v Belcher[1]. Citing this case, and looking at what was actually going on, it was inevitable that the tribunal rejected Uber’s position that firstly they were not a transportation company (yes Uber did actually argue that they were not a taxi company, but rather a technology company!!), and secondly that they did not have a contractual relationship with the drivers (this was despite submissions for Uber that they were simply a common ‘platform’ through which all of these independent businesses could grow, which was not accepted, and that all Uber did was provide drivers with ‘leads’, which was rejected due to the control Uber exerted, including on price).

The reality, as determined by the tribunal is that Uber provides a taxi service, the drivers are recruited and retained for the purpose of Uber’s taxi services, and are paid when they, having made themselves available for work through an app, taxi an Uber customer to their destination. The contract was thus viewed as being between the driver and Uber, rather than the driver and the customer, with Uber simply being matchmaker.

There is a counter argument to this finding, which did not seem to be pushed, and that would be based on what the parties intended when they entered the contract. If the intentions of both parties were clearly not to have worker status, then it would be difficult to argue that a contract existed since the contractual position would reflect the reality of the relationship (this was one of Mr Reade’s, Counsel for Uber, submissions; however, would have needed consideration of cases such as Carmichael v National Power[2], Massey v Crown Life Insurance[3] and O’Kelly v Trusthouse Forte[4], which do not appear in the Tribunal transcript). I only raise this as a possibility as in depth discussion on this is beyond this blog piece.

(ii) Was this a worker contract?

Once it was decided that there was a contract between Uber and the drivers, the next question was to ask whether this was a worker contract in line with section 230(3)(b). A number of authorities were considered with respect this, including the dependent work relationship test, which was developed by Elias J when sitting in the EAT in James v Redcats Ltd[5], and was used to support a finding of worker status, given the dependency the drivers had on Uber for work. However, that is not the end of the quest, as this is implicitly referring to a key matter, that of mutuality and at one point does it exist.

Mutuality of obligation is important in determining worker status, with Mr Recorder Underhill QC in Byrne Brothers (Formwork) Ltd v Baird[6] identifying that‘…mutuality of obligation is a necessary element in a [worker contract] as well as in a contract of employment.’ However, according to Langstaff J in Cotswold Developments Construction Ltd v Williams[7] it is a less restricted approach to mutuality when considering worker status than that adopted for employee status’ and that the focus is ‘not upon any obligation owed by the employer (save sufficient to ensure that there is a contract between the "employer" and the "worker"), but upon the nature of the obligation resting upon the worker’., before identifying that the conclusion is often an easy one, given it is usually either an independent person who actively markets his services to the world in general or one ‘recruited by the principal to work for that principal as an integral part of the principal's operations’.

Bearing this in mind, the reality of the legal question that the Tribunal was considering was thus whether this less restrictive mutuality existed during the contract between Uber and the drivers, and if so, at what point did it exist, as it is during such periods where it did exist that the contract could then be considered to be a worker contract.

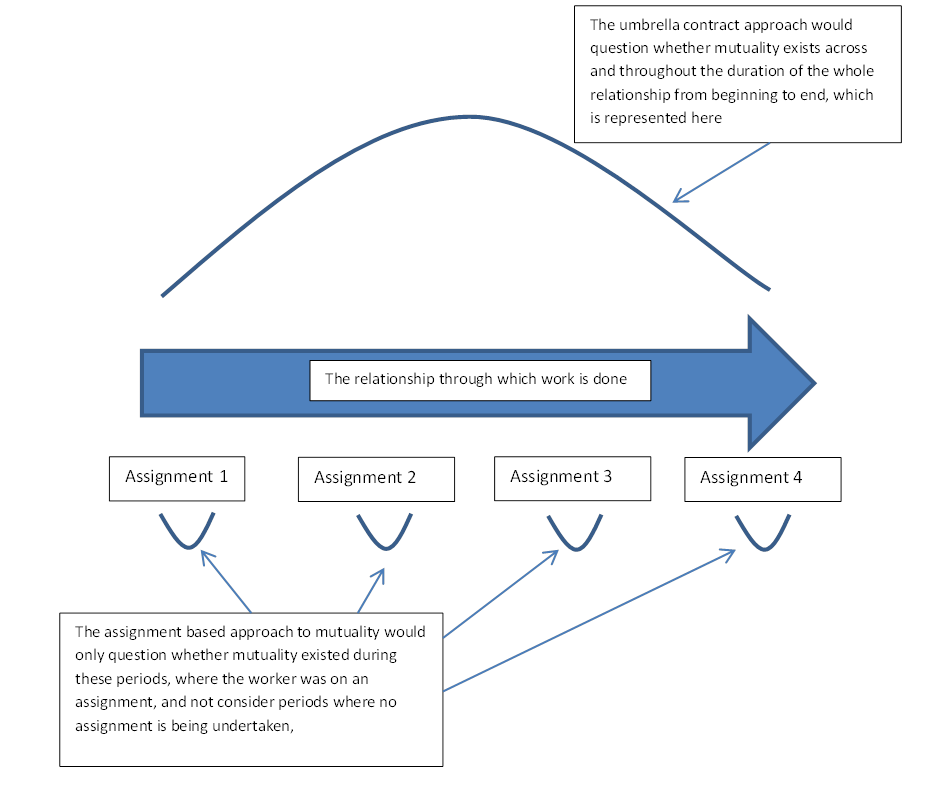

Mutuality is complicated in that case law developments have identified two different approaches depending on how work is arranged. The traditional approach is a consideration of whether mutuality exists in the contract from the day the work relationship begins through to the day that it either ends or the day of dispute (the “umbrella contract” approach). The alternative approach can be best seen in assignment based work, which involves considering whether mutuality exists during individual assignments rather than across the work relationship as a whole. Diagrammatically this would look like this:

The assignment based work approach to mutuality is most apt in arrangements such as that present in Uber, where across and throughout the duration of the whole relationship Uber were not obliged to offer work, nor was the driver obliged to accept work when it was offered. Instead it was on an assignment by assignment basis, whereby the driver had a relationship with Uber over a period of time, during which they were offered single assignments at varying times during the relationship. The driver would have periods where they were not offered work, then periods where work was offered to them through the app, at which point the driver could accept or reject the job that had been offered.

With the focus being on assignment based work, it was unsurprising when the Tribunal concluded that representatives for Uber had relied upon authorities that did not support the submissions made, in particular as they had relied upon authority that ‘concerned wholly or very largely’ the existence of an umbrella contract [para 95(2)]. A further criticism was that none of the authorities relied on were limb (b) authorities, or in other words, they were authorities that had not focussed on worker status, but rather on employee status. Although there were other reasons behind this conclusion, I think these are the most crucial.

It is difficult to identify relevant case law that would have satisfied the Tribunal, at least in terms of authorities that are focussed on both worker status and assignment based work. However, given that mutuality, as identified above, is less restrictive when considering worker status relative to employee status, then understanding how mutuality is interpreted for employee status in assignment based work is useful. Fortunately we have strong authority in the form of the Court of Appeal decision in Cornwall CC v. Prater[8].

This case involved Mrs Prater, a teacher, who was not employed continuously by the Council. Instead the Council maintained a bank of home tutors to teach pupils who could not attend school for whatever reason. Mrs Prater was one of these home tutors. The Council would match such pupils with a suitable tutor. The tutor would be offered work, and be free to accept or reject the offer. The Council were not contractually obliged to offer work, nor was Mrs Prater contractually obliged to accept any work offered. Importantly, once Mrs Prater agreed to take on a pupil she was obliged to complete the assignment, and the Council was obliged to continue to provide that work and pay her until the assignment ended.

The important part of the judgment on these facts can be read at paragraph 40 (5):

‘…The important point is that, once a contract was entered into and while that contract continued, she was under an obligation to teach the pupil and the Council was under an obligation to pay her for teaching the pupil made available to her by the Council under that contract. That was all that was legally necessary to support the finding that each individual teaching engagement was a contract of service…’

A number of clear parallels can be drawn between the Uber case and Prater. Both involved:

- a bank of people who could provide a service, of which their purported employer was such a ‘service provider’

- situations where there was no obligation to offer or accept work for the entirety of the relationship

- work offered through individual assignments

- an obligation for an individual to complete the work once an assignment had been accepted, with the service provider being obliged to continue to provide that accepted assignment up until its completion, and pay once it had been completed.

The final point is crucial, and as such I will further elaborate using the Uber decision. In Uber, at para 53, the Tribunal identified that part of the agreement between the driver and Uber is an obligation to complete a job once it has been accepted. If a job is cancelled after acceptance this is described as a breach of agreement and a 10 minute log-off penalty will be applied.

Applying the approach in Prater to Uber, bearing in mind this is the highest authority we have in the UK on mutuality in assignment based work, it is clear that once a job is accepted by a driver then they are contractually obliging themselves to complete the work personally, Uber is obligated to allow the driver to complete the work and will pay on completion, thus leading to mutuality existing from the moment a job is accepted until the moment that it is completed.

The Tribunal deciding that mutuality and thus worker status existing when a driver has (a) switched on the app, (b) is within the territory in which he is authorised to work, and (c) is able and willing to accept assignments, appears be a very much expanded approach to mutuality, beyond what is supported by current precedent, although this would depend on whether this same approach was adopted in relation to worker status as it was to employee status in Prater; however, if the same approach is adopted then Uber are likely to succeed in their appeal before the Employment Appeals Tribunal. Interestingly, the Tribunal provides an alternative position, which sits comfortably with the Prater decision:

‘In case we are wrong in our primary conclusion, we would hold in the alternative that, at the very latest, the driver is ‘working’ for Uber from the moment that he accepts any trip. He is then bound, subject to the cancellation policy, to complete the trip…’ [para 102]

In my opinion this is the likely point of appeal on which Uber will succeed, with worker status eventually being restricted to a much shorter period of time.

There are clear practical problems attached to the current primary conclusion of the Tribunal too, and ones which the Appeal Tribunal is likely to want to avoid, even if they opt to apply a less restrictive approach to mutuality. Taking the decision to its extreme, the Tribunal’s primary approach would enable drivers to request payment for simply logging on to the app and being within their area of service and claiming to be willing and able, even if they positioned themselves within that area such that they were unlikely to be offered a job (given distance to customer was a consideration by Uber when offering a job), or where they had good reason for rejecting a job when offered (although this is against the caveat that the more jobs rejected the harder it would be for a driver to argue that they were able and willing to accept jobs). This would lead to worker status, thus minimum wage and holiday entitlement, in circumstances where no personal work was being provided to Uber. This would be avoided if the Appeal Tribunal adopts the Tribunal’s alternative position.

Appeal a finding of worker status?

Arguably this is possible, as alluded to earlier, through submissions concerning the intentions and views of the parties and on the recognised custom and practice in this industry (O’Kelly could be relied upon in this respect); however, Uber, in their appeal, should be wary of pushing the Employment Appeal Tribunal toward a finding of independent contractor status. Such a finding would remove rights attached to worker status, but would mean competition law would apply given this landscape would now involve 1,000’s of separate businesses. The last thing Uber would want is claims based on competition law principles (in particular investigation into their pricing model, which may be considered vertical price fixing), which could end up more costly for the company.

A safe bet for Uber is to appeal, but restrict their submissions to limiting worker status as far as possible, which means arguing that worker status only exists from the moment a taxi job is accepted until it is completed. Although this will mean minimum wage and holiday pay entitlement, this is unlikely to be too damaging to the model…

[1] [2011] UKSC 41.

[2] [1999] UKHL 47.

[3] [1977] EWCA Civ 12.

[4] [1983] ICR 728.

[5] [2007] ICR 1006.

[6] [2001] UKEAT 542_01_1809.

[7] [2005] UKEAT 0457_05_2112

[8] [2006] EWCA Civ 102

.jpg)